The City of Kingston might opt into the Emergency Tenant Protection Act (ETPA). It is a law that was enacted to help protect renters in places where there’s a 5% vacancy rate or below. A 6-10% vacancy rate is typically cited as a healthy vacancy rate for towns.

The ETPA includes rent stabilization, the right to lease renewal, the right to a one to two year lease, additional enforcement for timely repairs, and the ability for tenants to sue to have their rent returned to a fair market rate. It applies to apartments built before 1974, in buildings or complexes with 6+ units.

In early 2019, the Ulster County Rental Survey stated that Kingston has a 0.5% vacancy rate. Other statistics show that evictions in Kingston and Ulster County have reached an all-time high, that nearly three in every 100 Ulster County housing units is an Airbnb, and that median local wages have remained stagnant since 2000 while median rents have increased 30-50%.

The city is conducting an important rental survey that will officially confirm if the city can opt into the ETPA. While that’s being done, we’ve put out a fact sheet and petition about the ETPA, and have been canvassing Kingston renters about the law, but we wanted to put out some additional information.

1. 36 municipalities have already adopted the ETPA in New York State

Baxter Estates, Cedarhurst, Croton, Dobbs Ferry, Eastchester, Floral Park, Freeport, Glen Cove, Great Neck, Great Neck Plaza, Greenburgh, Harrison, Hastings, Haverstraw, Hempstead, Irvington, Larchmont, Long Beach, Lynbrook, Mamaroneck Town, Mineola, Mount Kisco, Mount Vernon, New Rochelle, North Hempstead, Ossining, Pleasantville, Port Chester, Rockville Center, Russell Gardens, Sleepy Hollow, Spring Valley, Tarrytown, Thomaston, White Plains and Yonkers.

Until June of 2019, only municipalities in Rockland, Westchester and Nassau counties could opt into the ETPA.

With the passage of the Housing Stability and Tenant Protection Act of 2019, municipalities anywhere in New York State are now able to opt in, provided they are experiencing a “housing emergency.” For this law, a housing emergency is defined as a vacancy rate below 5% in apartments in buildings/complexes with 6+ units built before 1974.

To determine if the City of Kingston is experiencing a housing emergency, an official study is in progress, and is expected to be completed by the end of the year.

2. It doesn’t apply to apartments that are already subsidized for affordability

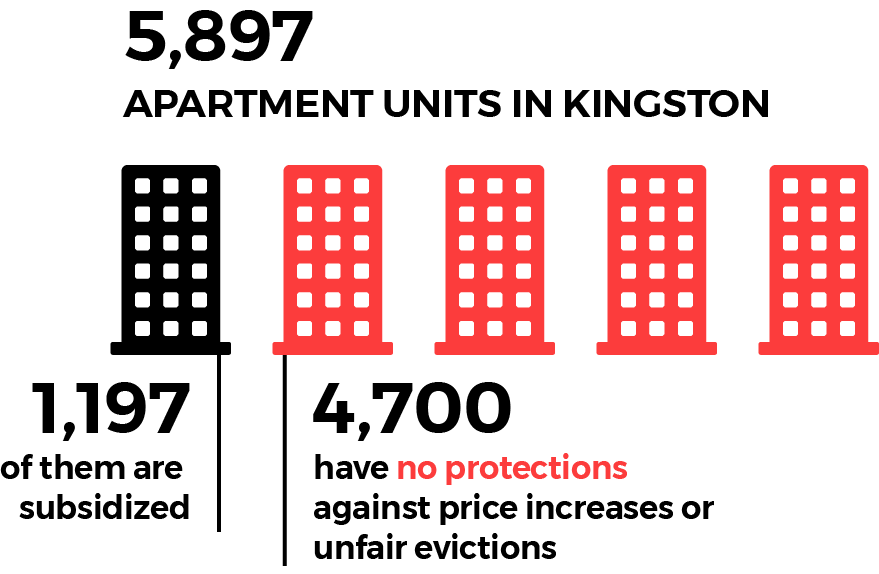

Kingston has close to 6,000 apartments, making up about 53% of the city’s housing. The ETPA applies to unsubsidized housing, in complexes and buildings with 6+ units built before 1974.

Kingston has about 1,200 apartments that are already subsidized for affordable housing, including places like:

Those apartments will not be covered under the ETPA.

We estimate that about 1,233 apartments may qualify for protection under the ETPA. When combined with the apartments above, about 40% of Kingston’s tenants would be protected from major price increases and housing insecurity.

3. It applies to some large apartment complexes

We believe that the ETPA applies to the following apartment complexes:

- Camelot Manor

- Chestnut Mansion

- Dutch Village

- Fairview Gardens

- Park View Terrace

- Stony Run Apartments

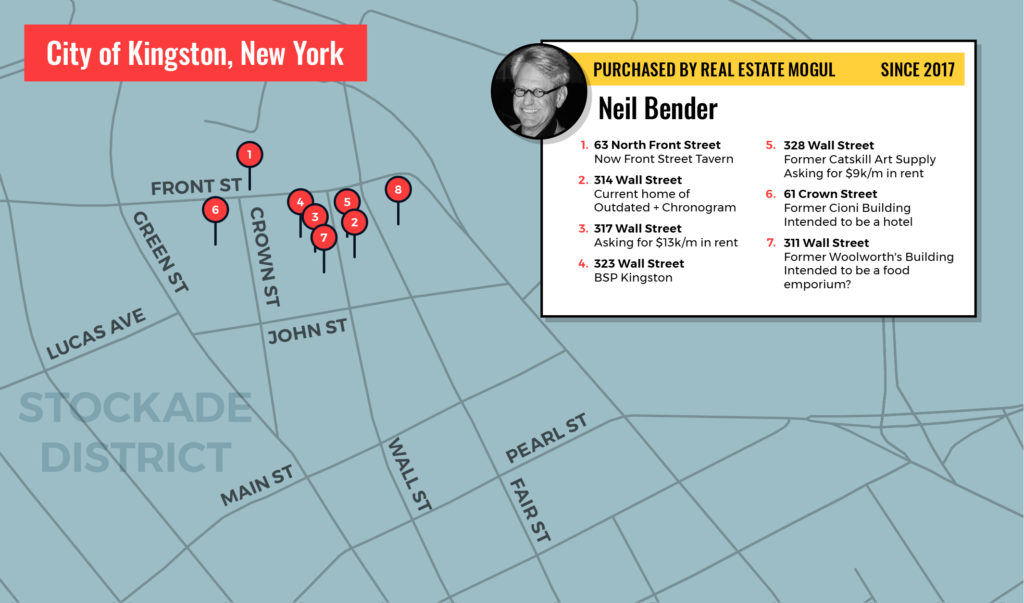

Three of those apartment complexes, Chestnut Mansion, Dutch Village, and Stony Run Apartments, were recently purchased by NYC real estate investors with a long-documented history of exploiting lax rental laws to maximize profits, at the expense of lower-income tenants.

They’ve been documented in the NY Times (The Eviction Machine Churning Through New York City), The Real Deal (Controversial Landlord Ramps Up in the Hudson Valley), and as a “dishonorable mention” on the NYC Worst Evictors website.

The local press has reported on how they’ve been doing the same thing for the last year and a half.

While tenants at Camelot Manor, Fairview Gardens and Park View Terrace have not been reporting nearly the level of problems as the other complexes, there’s the possibility that E&M, their former employee Isaac “Yitz” Horowitz, or another aggressive investor will buy their complexes and start doing the same thing, at any time. The ETPA protects those 220 households from such an outcome.

4. It also applies to lots of smaller buildings

We’ve identified about 550 apartments across the City of Kingston that are in buildings with 6+ units built before 1974. These apartments are located all over the city:

These renters aren’t getting headlines because most of the landlords are smaller, but when we canvass them, we’re hearing similar stories:

- New owners are constantly coming in and not renewing rents, or jacking up rents

- Rents are going up with existing landlords

- The threat of Airbnb conversion is always there

- Needed repairs aren’t getting done

- If a tenant gets displaced, there are no alternatives

5. Rents are increasing for people with both corporate and small landlords

There have been reports and sightings of $300-500 increases for tenants at larger complexes. Things are just as bad for tenants of smaller buildings; real estate ads for ETPA-covered apartments often say how the rents are “under-market” and that the new owner could easily jack up the rents by hundreds of dollars.

Here are some examples:

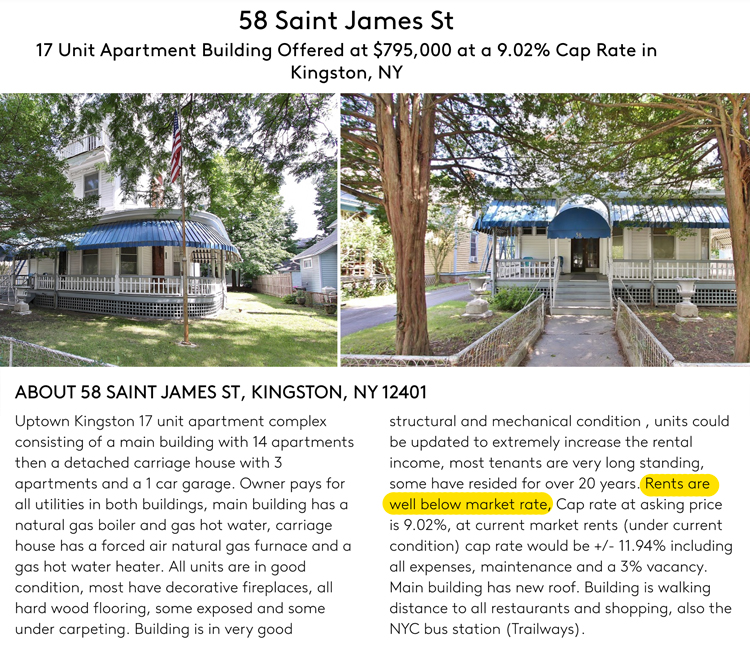

58 St. James Street, 17 Apartment Building

“Building is in very good structural and mechanical condition , units could be updated to extremely increase the rental income, most tenants are very long standing, some have resided for over 20 years. Rents are well below market rate.”

The ad includes a marketing brochure, showing that while holding rents at existing rates, the property clears $77,297 annually in profit, after factoring in all utilities, taxes, insurance, repairs and maintenance. However, the ad suggests that after raising rents on tenants by 20-30% across the board (including on tenants who have been there for over 20 years), the new owner could take in $104,821 annually in profit, for a “cap rate” of 13% (a cap rate is the rate at which a property investment is paid back, meaning that an investor could recoup their money in 6 or 7 years before generating pure profit).

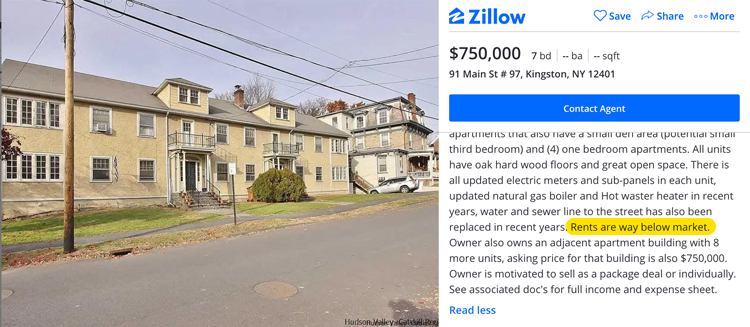

91 Main Street, 7 Apartment Building

“Property is located easy walking distance to all shops, eateries, farmers market… Rents are way below market.”

This property’s brochure says that while holding rents at existing rates, the property clears $44,000 in profits after all expenses (including repairs and maintenance) are paid. After a 20% suggested rent increase, the new owner could generate $59,000 in profits after all expenses, for a cap rate of nearly 8%.

87 Green Street, 8 Apartment Building

“This is a very well run and managed property, rents are well below market. I would estimate each apartment is $100 to $300 a month under market rent in their current condition.”

Currently, the property clears $41,000 annually after all expenses. It’s suggested that the new landlord raise rents by 30-40%, to generate $68,000 in profits annually, for a cap rate of 9%.

These examples are not the worst of the worst, or from a company like E&M. This is just normal.

6. It stabilizes rents from going up too much, as defined by diverse local stakeholders

What’s the definition of too much? The yearly allowable rent increase will be determined by a county government-appointed board that needs to represent a broad cross-section of the community. It will be very important that representatives are elected to the board who are tenants and understand how challenging it is to be a tenant in our community, especially for people marginalized because of their race, gender, sexuality, disability or any other reason or combination of factors.

Anecdotally, most rent increases from other communities range between 1-3%.

7. It protects tenants when landlords change

Kingston is a hot real estate market. Even if a tenant has a good relationship with their current landlord, that landlord can easily sell their property to less scrupulous landlord. The ETPA boosts tenants’ rights so that tenants aren’t as reliant on lucking into a great landlord.

8. It doesn’t increase property taxes

In 2018, The Earth Institute of Columbia University’s Center for Sustainable Development conducted an impact study of the Emergency Tenant Protection Act on 44 towns, cities and villages in Westchester County. They concluded that the ETPA has “no perceptible effect on local property values or property taxes across the municipalities of Westchester County.”

ETPA has “no perceptible effect on local property values or property taxes”

9. It doesn’t apply to new construction

The ETPA only applies to buildings with 6+ apartments built before 1974. It does not apply to or prevent new construction or renovations.

10. It gives tenants more freedom to organize and participate in community

Tenants technically can organize right now, but at great risk. If they’re spotted at City Hall or meeting with other tenants, they face the following risks, which will all be helped by the ETPA:

- Landlord raising their rent raised in retaliation

- Landlord neglects needed repairs in hopes of tenant leaving

- Landlord refuses to offer a lease renewal

Additionally, tenants live under the constant threat of homelessness or having to move, leaving less time and mental space than homeowners have to get involved with local initiatives or to vote. Having concrete protections will help 1,200 Kingston households participate in our community. Many tenants have amazing ideas and are passionate about housing everyone in our community, but can’t participate due to the threat of retaliation.

11. The ETPA buys a little time to end homelessness and housing insecurity, locally and nationally

The ETPA is not a solution to end homelessness, housing insecurity or right any of the wrongs of generations of racist and exclusionary policies and structures. However, it does provide some real protections for some working class tenants to remain in our rapidly gentrifying city.

There are many proposals for ending homelessness and housing insecurity from different politicians, coalitions, and organizations on a city, county, statewide and national level, ranging all the way from individual aldermen to presidential candidates.

It is not fair to make tenants bear the brunt of evictions and rent increases while a larger discussion is had.

Whatever happens, giving these 1,200+ households real protections to stay in their homes while the political and public opinion battle is waged is the best option we have in the short term. It is not fair to make tenants bear the brunt of gentrification and rent increases while a larger discussion is had.

We’ve counted over 20 local, inclusive and civil community conversations, book readings, film screenings, government hearings, summits, visioning sessions, and speak-outs where all of the basic questions have been asked and answered, over and over for the last two years. Whatever plans to end homelessness and housing insecurity will require years to implement; meanwhile, the ETPA is here to ensure that some tenants in Kingston right now will still be around to be part of an eventual solution.

12. The ETPA is not nearly enough

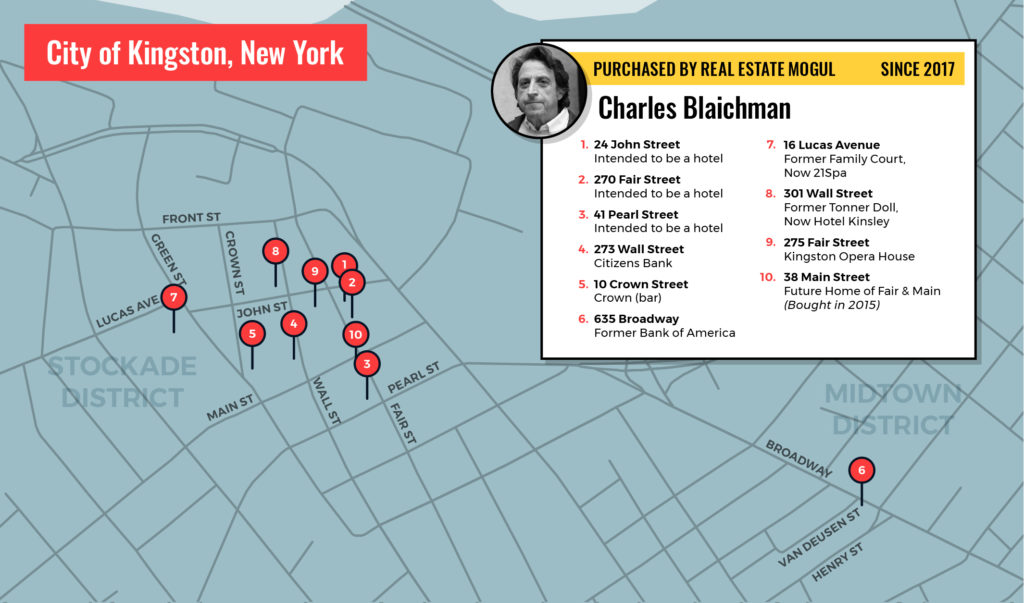

Kingston is getting hit with a wave of gentrification. Billionaire and millionaire investors, mostly from NYC, have been buying up buildings and apartment complexes, seeking PILOTs, jacking up rents and letting buildings sit empty while waiting for luxury tenants.

The investors don’t seem interested in having civil and inclusive discussions about what gentrification is or why it’s problematic; they’re interested in making as much money as quickly as possible.

Their purchases represent over $70M of rapid investment that we know of, a massive injection of capital in just two years. In many cases, these properties were bought for two or three times the assessed value of the properties, sending ripple effects through Kingston’s already fragile tenant population.

While were publishing this, we also got news that the Shirt Factory, Pajama Factory and Brush Factory were purchased by an NYC private equity firm for over triple their assessed value, citing a “vibrant culture of growth in the Midtown Arts District and City of Kingston as a whole.” The properties are being purchased for over triple their assessed value, indicating that the new owners most likely intend to raise rents and attract a new mix of tenants.

Charles Blaichman:

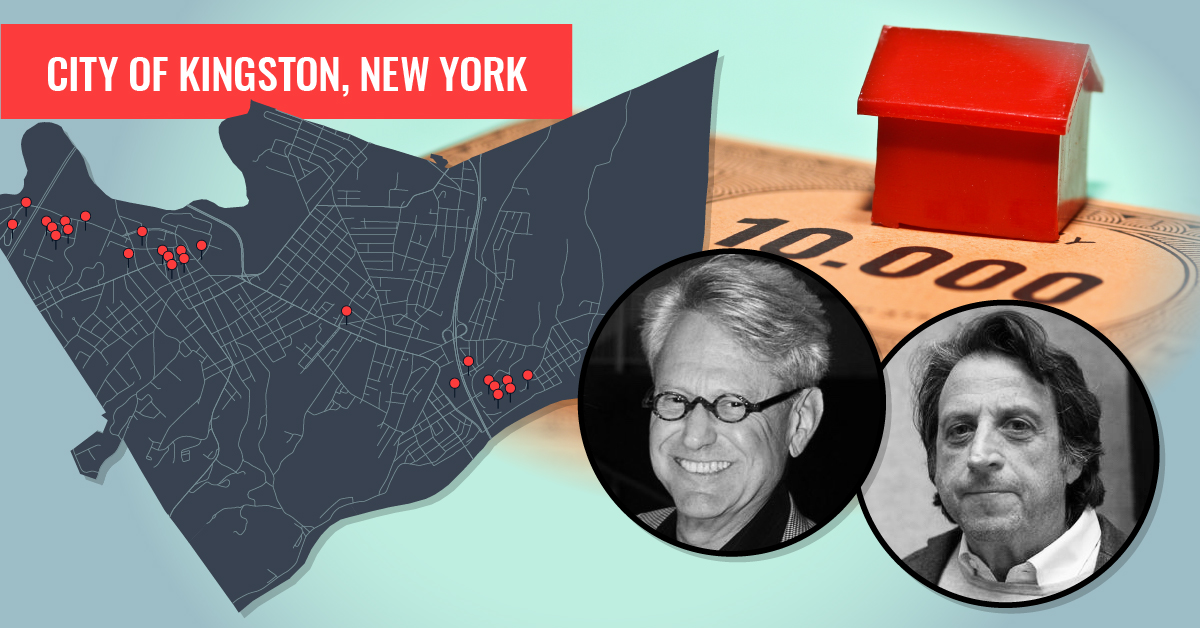

Neil Bender:

E&M Management and/or Isaac Horowitz

Map of all properties and new owners:

Even if the ETPA is fully enacted tomorrow, there still would be over 3,000 tenant households in the City of Kingston alone that don’t have the right to lease renewal, protection against landlord retaliation and harassment, rent stabilization, or protections against their apartment getting converted into an Airbnb hotel.

There are lots of things that can be done locally, including inclusionary zoning, a community land trust, a vacancy tax that funds affordable housing, taking legal action to remove the tenant blacklist at Kingston Landlord Support, creating a housing mediation system, guaranteeing tenants an attorney in eviction proceedings, stricter code enforcement that also protects tenants against displacement resulting from the landlord’s code violations, putting a moratorium on Airbnb and more strenuous regulations for existing whole-home hosts, seizing buildings from absentee landlords who have code violations and giving them to tenants (or at least providing funding to fix up the buildings while guaranteeing affordable rent), creating dignified permanent housing for DSS clients, and vocally supporting the creation of co-operatively owned, publicly owned, or ANY affordable housing in all possible forms, wherever it is proposed: Uptown, Downtown in Midtown and anywhere in Ulster County with adequate access to public transportation.

Kingston is not in a vacuum. E&M Management has bought properties in the Town of Ulster, Esopus and Highland. Evictions have doubled or tripled in some of the small towns across the county, and at last check, 2019 was projected to have the most county-wide evictions ever recorded. In addition to enacting the ETPA in other Ulster County municipalities, other county-wide interventions are sorely needed.

On a statewide level, the Housing Justice for All coalition is launching a “NY Homes Guarantee,” a comprehensive plan to provide rent stabilization and good cause eviction for all tenants while building the housing needed to end homelessness, and to pay for it.

On a national level, groups like PUSH Buffalo, KC Tenants Union, Community Voices Heard, Data for Progress, and many more have endorsed a National Homes Guarantee, which was created by directly-affected tenants and demands an unprecedented amount of funding to address the crisis that we’re in.

13. Kingston had full rent control from 1943 to 1957

If you’re a long-time Kingston resident, you may know that what we’re asking for isn’t unprecedented. In fact, it’s far short of the tenants rights that Kingston used to have.

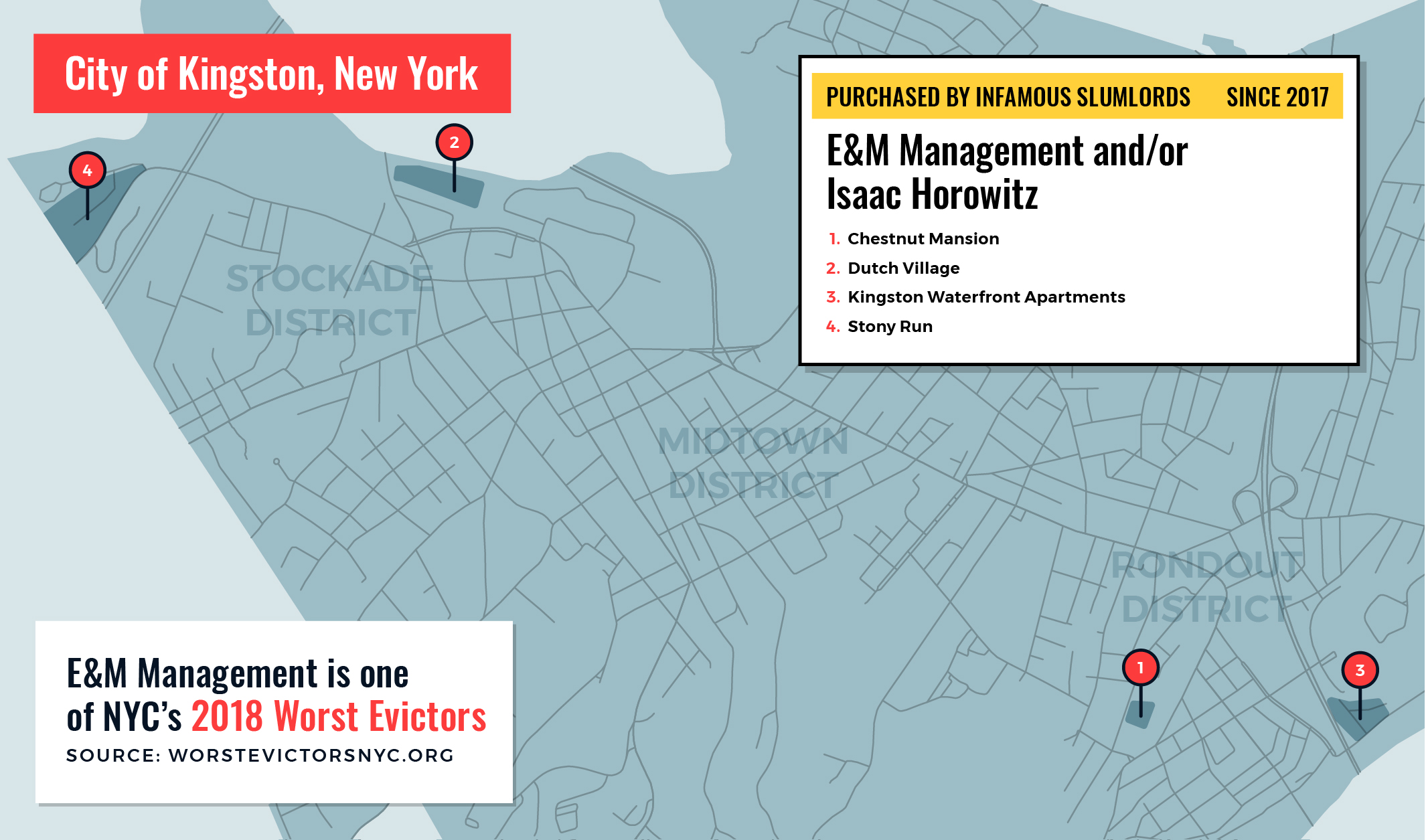

In 1943, the federal government enacted the Emergency Price Control Act, freezing rents nationwide. When the wartime bill expired in 1947, Congress passed the Federal Housing and Rent Act of 1947, which was locally taken over by NYS in 1950. The real estate industry and landlord lobby began town-by-town lobbying efforts to chip away at the law, culminating in Kingston deregulating rents in late 1957.

That means that for a 14 year period, Kingston had full rent control for over 3,000 apartments in the city, a period that saw IBM locate a factory in the community. That’s right: Kingston was a great environment for investment while rent control was in place!

Here’s how decontrol happened in Kingston:

June 17, 1957: After reports of a raucous hearing in Poughkeepsie that resulted in a 5-4 vote to decontrol rents, a public hearing was scheduled for July 12 at City Hall.

July 12: It’s reported that “not a single voice was raised in opposition to decontrol of rents” at the public hearing. Fifteen landlords, supported by a group of 100 property owners, packed City Hall and said that rent control was incompatible with modern day operating costs. The hearing only lasted 45 minutes.

A landlord named Henry Millonig, who owned apartments on Franklin and Pine Streets, “noted an inequality in the present day wages of tenants compared to rents charged. He said that current incomes show an increase of ‘more than 15 per cent in the last 12 years’ and he was opposed to rent control.”

NOTE: Since 2000, median rents in Kingston have increased by 30-50% (depending on the type of housing), while median wages have decreased slightly.

August 6: The Kingston Common Council voted 9-2 in favor of rental decontrol, citing the fact that no tenants spoke at the hearing.

We’d like to acknowledge the two alderman who spoke against decontrol, in statements that also ring true today:

Hirschell Mayes, 1st Ward, “spoke chiefly in behalf of older residents of the city, to whom, he felt, decontrol would bring hardship. Rent control, he said, was never needed more.”

George F. McArdle, 13th Ward, “felt that decontrol could add to financial difficulties of local residents who were now hard pressed in meeting week-by-week expenses.”